Yes! You can use AI to fill out Form 941, Employer’s Quarterly Federal Tax Return

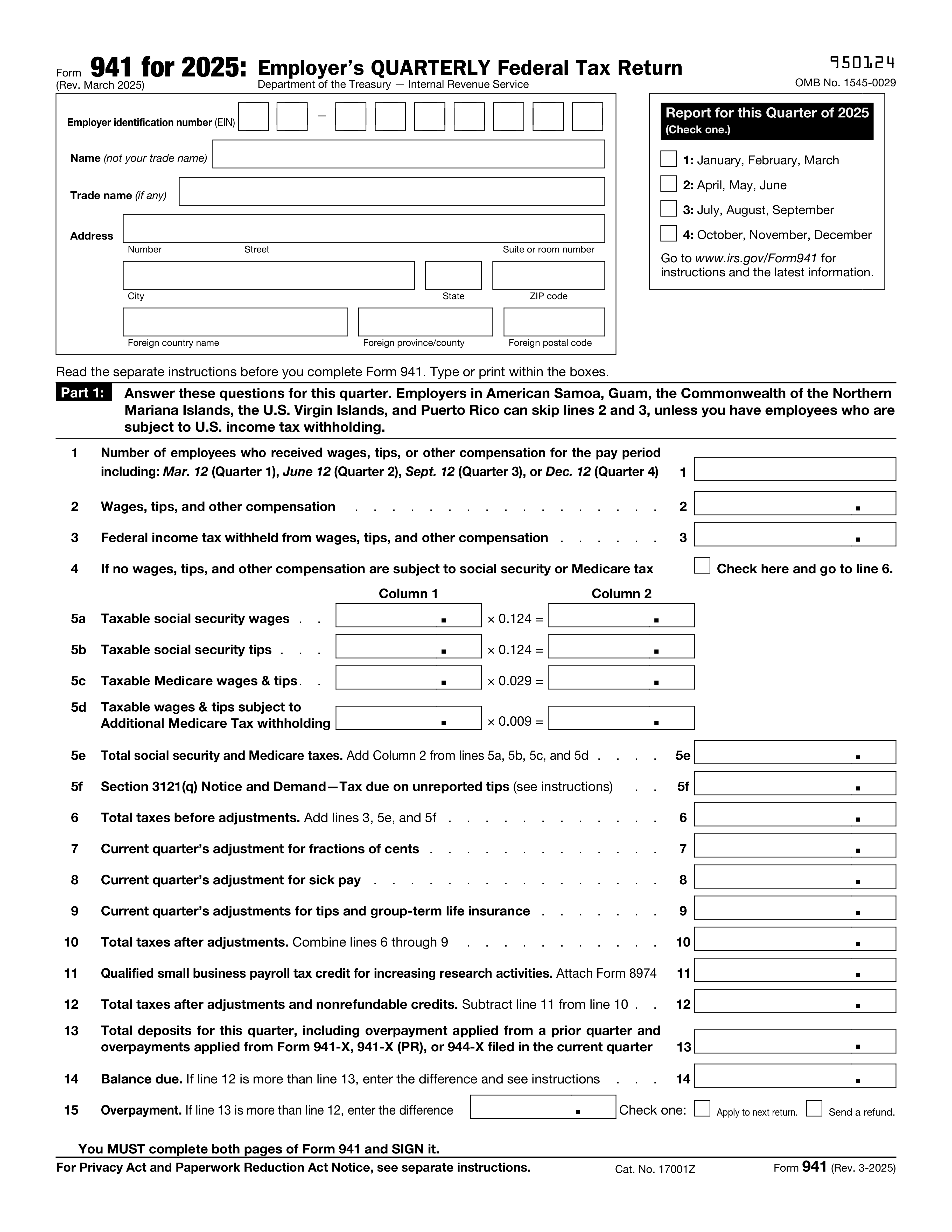

Form 941, Employer’s Quarterly Federal Tax Return, is a document used by employers to report the income taxes, social security tax, or Medicare tax withheld from employee's paychecks. It also includes the employer's portion of social security or Medicare tax. This form is crucial for ensuring compliance with federal tax laws and for the accurate reporting of employment taxes.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 941 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 941, Employer’s Quarterly Federal Tax Return |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 109 |

| Number of pages: | 3 |

| Version: | 2025 |

| Official download URL: | https://www.irs.gov/pub/irs-pdf/f941.pdf |

| Instructions: | https://www.irs.gov/pub/irs-pdf/i941.pdf |

| Language: | English |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 941 Online for Free in 2025

Are you looking to fill out a IRS-941 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2025, allowing you to complete your IRS-941 form in just 37 seconds or less.

Follow these steps to fill out your IRS-941 form online using Instafill.ai:

- 1 Visit instafill.ai and select Form 941.

- 2 Enter your Employer Identification Number (EIN).

- 3 Provide your business name and address.

- 4 Select the quarter you're reporting for.

- 5 Fill in employee count and compensation details.

- 6 Calculate and enter total taxes and adjustments.

- 7 Sign and date the form electronically.

- 8 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 941 Form?

Speed

Complete your Form 941 in as little as 37 seconds.

Up-to-Date

Always use the latest 2025 Form 941 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 941

Form 941, Employer’s Quarterly Federal Tax Return, is a tax form used by employers to report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks and to pay the employer's portion of Social Security or Medicare tax. Employers who pay wages subject to income tax withholding (including withholding on sick pay and supplemental unemployment benefits) or Social Security and Medicare taxes must file Form 941 each quarter.

Your deposit schedule for Form 941 is determined by the total tax liability you reported during a four-quarter lookback period. If your total tax liability was $50,000 or less in the lookback period, you are a monthly schedule depositor. If it was more than $50,000, you are a semi-weekly schedule depositor. The IRS will notify you of your deposit schedule, but it's important to know how it's determined to ensure compliance.

The deadlines for filing Form 941 each quarter are as follows: for the first quarter (January, February, March), the deadline is April 30; for the second quarter (April, May, June), the deadline is July 31; for the third quarter (July, August, September), the deadline is October 31; and for the fourth quarter (October, November, December), the deadline is January 31 of the following year. If the due date falls on a weekend or a legal holiday, the deadline is the next business day.

To calculate the total taxes before adjustments on Form 941, add up the federal income tax withheld from employees' wages, the employees' share of Social Security and Medicare taxes, and the employer's share of Social Security and Medicare taxes. This total is reported on Line 10 of Form 941. It's important to accurately calculate these amounts to ensure correct reporting and payment of taxes.

If you have no wages subject to Social Security or Medicare tax during a quarter, you still need to file Form 941 if you have employees and are required to withhold federal income tax. However, you can indicate that no wages were subject to Social Security or Medicare tax by entering zero in the appropriate lines on the form. It's important to file the form even if you have no tax liability to report, to maintain compliance with IRS requirements.

Adjustments for fractions of cents, sick pay, and tips on Form 941 should be reported in the appropriate lines designated for these adjustments. For fractions of cents, you can round to the nearest whole cent. Sick pay adjustments are reported if you are reimbursed for payments made to employees. Tips reported by employees should be included in the total wages, tips, and other compensation. Ensure to follow the specific instructions provided in the Form 941 instructions for accurate reporting.

The qualified small business payroll tax credit for increasing research activities is a credit available to eligible small businesses that incur research and development expenses. To claim this credit on Form 941, you must complete Form 8974, Qualified Small Business Payroll Tax Credit for Increasing Research Activities, and attach it to your Form 941. The credit amount is then entered on the designated line for payroll tax credits on Form 941. Ensure to review the eligibility criteria and instructions for Form 8974 to correctly calculate and claim the credit.

If you have an overpayment on Form 941, you can choose to have it refunded or applied to your next return. To request a refund, you must file Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund, and indicate the overpayment amount. If you prefer to apply the overpayment to your next return, you can do so by indicating this choice on your current Form 941. Ensure to follow the instructions provided on Form 941 and Form 941-X for accurate handling of overpayments.

The penalties for not making timely deposits for Form 941 depend on the amount of the deposit and how late the payment is. The IRS imposes a penalty ranging from 2% to 15% of the unpaid deposit, depending on the number of days the deposit is late. Additionally, interest may be charged on the unpaid tax from the due date of the deposit until the date of payment. It's important to make deposits on time to avoid these penalties and interest charges.

To apply for an Employer Identification Number (EIN) if you don't have one, you can apply online through the IRS website, by fax, or by mail. The online application is the fastest method and is available on the IRS website. You will need to provide information about your business, such as the legal name, trade name (if any), address, and the type of entity. Once your application is processed, you will receive your EIN immediately if applying online, or within a few weeks if applying by fax or mail. Ensure to have all necessary information ready before starting the application process.

If your business has closed or you have stopped paying wages, you must still file Form 941 for the final quarter in which wages were paid. Indicate that this is your final return by checking the box in Part 1 of the form. Additionally, you should notify the IRS of your business closure by following the instructions provided on the IRS website or by contacting them directly.

To indicate that you are a seasonal employer on Form 941, check the box in Part 1 of the form that says 'Seasonal employer.' This designation informs the IRS that you do not have to file a return for quarters in which you have no tax liability because you did not pay wages.

Yes, you can authorize a third-party designee, such as an accountant or tax preparer, to discuss your Form 941 with the IRS. To do this, complete the Third-Party Designee section in Part 3 of Form 941. You must provide the designee's name, phone number, and a personal identification number (PIN) that you create. This authorization allows the designee to speak with the IRS about the specific form and tax period indicated.

Form 941-V, Payment Voucher, is used when making a payment with Form 941, Employer’s Quarterly Federal Tax Return. It serves as a voucher to accompany your payment, ensuring that your payment is correctly applied to your tax account. Use Form 941-V if you are mailing a check or money order with your Form 941. It is not necessary if you are making an electronic payment.

To make a payment with Form 941-V, complete the voucher with your employer identification number (EIN), the tax period, and the amount you are paying. Attach your check or money order to the voucher and mail it to the address provided in the Form 941 instructions. Ensure that your payment is postmarked by the due date to avoid penalties and interest. Note that Form 941-V is only for payments made by mail; electronic payments do not require a voucher.

Part 2 of Form 941 requires information about your deposit schedule and tax liability for the quarter. You must indicate whether you are a monthly schedule depositor or a semi-weekly schedule depositor. Additionally, you need to report the total tax liability for the quarter before adjustments, any adjustments for the current quarter, and the total tax liability after adjustments. This section helps the IRS determine if you have met your federal tax deposit requirements for the quarter.

To report taxable social security wages, tips, and Medicare wages & tips on Form 941, you must complete Lines 5a through 5d. Line 5a is for reporting wages subject to social security tax, Line 5b is for tips subject to social security tax, Line 5c is for wages subject to Medicare tax, and Line 5d is for tips subject to Medicare tax. Ensure that the amounts reported are accurate and reflect the total wages and tips paid to employees during the quarter.

The signature section of Form 941 must be completed by an authorized individual, such as the business owner, a partner, or an officer of the corporation. The individual must sign and date the form, and provide their title. If the form is prepared by a third party, the preparer must also complete the 'Paid Preparer Use Only' section, including their signature, date, and Preparer Tax Identification Number (PTIN). This ensures that the form is properly authorized and submitted.

The number of employees who received wages, tips, or other compensation during the quarter is reported on Line 2 of Form 941. This number should reflect the total count of employees who were paid during the quarter, regardless of the amount they were paid. It is important to provide an accurate count as this information is used by the IRS to verify employment tax liabilities.

If you need to make adjustments for tips and group-term life insurance on Form 941, you should complete Lines 7a through 7d. Line 7a is for adjustments for tips, Line 7b is for adjustments for group-term life insurance, Line 7c is for other adjustments, and Line 7d is for the total adjustments. These adjustments are necessary to correct any discrepancies in the amounts previously reported and to ensure that the total tax liability is accurately calculated.

Compliance Form 941

Validation Checks by Instafill.ai

1

Verifies that the form is being filed by an employer who pays wages subject to federal income tax withholding or social security and Medicare taxes, ensuring compliance with filing requirements.

The AI software ensures that the entity filing Form 941 is indeed an employer obligated to pay wages subject to federal income tax withholding or social security and Medicare taxes. It verifies the employer's eligibility and compliance with the IRS's filing requirements, preventing non-compliant entities from filing. This check is crucial for maintaining the integrity of the tax system and ensuring that only eligible employers are submitting the form. It also helps in identifying any discrepancies in the employer's status that might affect the filing process.

2

Confirms that all necessary wage, tip, and other compensation information, along with federal income tax withheld and both employer and employee shares of social security and Medicare taxes, have been accurately gathered.

The software meticulously confirms the accuracy and completeness of all wage, tip, and other compensation data reported on Form 941. It ensures that the federal income tax withheld, as well as both the employer and employee shares of social security and Medicare taxes, are accurately calculated and reported. This validation is essential for the correct computation of tax liabilities and contributions. It also aids in preventing errors that could lead to penalties or interest charges for the employer.

3

Ensures that Part 1 of the form is correctly completed, including accurate reporting of the number of employees, wages, tips, and other compensation, and federal income tax withheld.

The AI software verifies the accurate completion of Part 1 of Form 941, focusing on the correct reporting of the number of employees, wages, tips, and other compensation. It ensures that the federal income tax withheld is accurately reported, which is vital for the correct assessment of tax liabilities. This step is crucial for maintaining the accuracy of the employer's tax records and ensuring compliance with IRS regulations. It also helps in identifying any discrepancies or omissions in the reported data.

4

Validates the accurate calculation of taxable social security and Medicare wages and tips, and the total taxes before adjustments.

The software performs a detailed validation of the calculations for taxable social security and Medicare wages and tips, as well as the total taxes before any adjustments. It ensures that these calculations are accurate and in line with IRS guidelines, which is essential for the correct determination of tax liabilities. This validation helps in preventing calculation errors that could affect the employer's tax obligations. It also ensures that the employer is not overpaying or underpaying their taxes.

5

Checks for the correct application of necessary adjustments for fractions of cents, sick pay, tips, and group-term life insurance.

The AI software checks for the correct application of adjustments related to fractions of cents, sick pay, tips, and group-term life insurance on Form 941. It ensures that these adjustments are accurately applied according to IRS regulations, which is crucial for the correct calculation of tax liabilities. This validation helps in identifying any errors in the application of adjustments, ensuring that the employer's tax obligations are accurately reported. It also aids in preventing potential issues during IRS audits by ensuring compliance with all applicable tax laws and regulations.

6

Confirms the accurate determination of total taxes after adjustments and the correct subtraction of any nonrefundable credits.

The AI software ensures that the total taxes after adjustments are accurately calculated, taking into account any applicable adjustments. It then verifies the correct subtraction of nonrefundable credits from the total taxes, ensuring the final amount reflects the true tax liability. This step is crucial for maintaining the integrity of the tax return and ensuring compliance with IRS regulations. The software cross-checks these calculations with the provided financial data to confirm accuracy.

7

Ensures that total deposits for the quarter, including any overpayment from a prior quarter, are accurately reported.

The software verifies that all deposits made during the quarter, including any overpayments carried over from previous quarters, are accurately reported on the form. It ensures that these figures are correctly entered to reflect the total deposits, which is essential for calculating the correct balance due or overpayment. This validation step helps in preventing discrepancies that could lead to penalties or interest charges. The AI cross-references these amounts with the employer's deposit records to ensure consistency and accuracy.

8

Validates the correct calculation of the balance due or overpayment, based on the comparison of total taxes after adjustments and nonrefundable credits with total deposits.

The AI software performs a detailed comparison between the total taxes after adjustments and nonrefundable credits against the total deposits for the quarter. It ensures that the balance due or overpayment is accurately calculated, reflecting the true financial obligation or credit of the employer. This step is critical for ensuring that the employer either pays the correct amount of taxes owed or receives the appropriate refund. The software meticulously checks these calculations to prevent any errors that could affect the employer's tax liabilities.

9

Confirms that Part 2 of the form is accurately completed, including the indication of the deposit schedule and tax liability for the quarter.

The software ensures that Part 2 of Form 941 is accurately completed, including the correct indication of the deposit schedule and the tax liability for the quarter. It verifies that the deposit schedule aligns with the employer's actual deposit activities and that the tax liability is accurately reported. This validation is essential for ensuring that the IRS has a clear understanding of the employer's tax obligations and deposit patterns. The AI cross-checks this information with the employer's financial records to ensure accuracy and compliance.

10

Ensures that Part 3 of the form is correctly filled out, providing necessary information about the business, including if it has closed or if it is a seasonal employer.

The AI software verifies that Part 3 of Form 941 is correctly filled out, ensuring that all necessary information about the business is accurately provided. This includes confirming whether the business has closed during the quarter or if it operates as a seasonal employer. The software checks that these details are correctly indicated, as they can significantly impact the employer's tax obligations and reporting requirements. This validation step ensures that the IRS has accurate and complete information about the employer's operational status.

11

Validates that the correct revision of Form 941 is used, specifically the March 2025 revision for the first quarter of 2025, to ensure compliance with current IRS requirements.

Ensures that the form being processed is the most current version as specified by the IRS, specifically the March 2025 revision for the first quarter of 2025. This validation is crucial for maintaining compliance with IRS regulations and avoiding potential penalties. It confirms that the form reflects the latest tax laws and reporting requirements. This step is essential for ensuring that the employer's quarterly federal tax return is accurately prepared and submitted.

12

Confirms that the form is signed and dated by an authorized person, ensuring the form's validity.

Verifies that the Form 941 has been properly signed and dated by an individual authorized to do so, such as the employer or a designated representative. This check is vital for the form's acceptance by the IRS, as it confirms the authenticity and authorization of the submission. It ensures that the form has been reviewed and approved by someone with the authority to represent the employer. This step is critical in preventing unauthorized submissions and ensuring the integrity of the tax reporting process.

13

Ensures that the form is submitted correctly, either electronically or by mail, to the appropriate IRS address based on the employer's location and whether a payment is included.

Confirms that Form 941 is submitted through the correct channel, whether electronically or via mail, and to the appropriate IRS address. This validation takes into account the employer's geographical location and whether the submission includes a payment, as these factors determine the correct submission method and address. It ensures that the form reaches the IRS in a timely manner and through the proper channels, reducing the risk of delays or misplacement. This step is crucial for the efficient processing of the employer's quarterly federal tax return.

14

Checks that all specific instructions for each part of the form have been followed to ensure accurate reporting and compliance with IRS requirements.

Verifies that all sections of Form 941 have been completed in accordance with the specific instructions provided by the IRS. This includes ensuring that all required fields are filled out accurately and that any applicable schedules or attachments are included. This validation is essential for accurate tax reporting and compliance, as it helps to identify and correct any errors or omissions before submission. It plays a key role in minimizing the risk of audits or penalties due to non-compliance or inaccuracies.

15

Verifies the optional authorization of a third-party designee to discuss the return with the IRS, if applicable.

Ensures that, if applicable, the optional authorization for a third-party designee to discuss the return with the IRS is correctly indicated on Form 941. This includes verifying that the designee's information is accurately provided and that the authorization is properly signed and dated. This step is important for employers who wish to designate a third party to communicate with the IRS on their behalf, ensuring that the authorization is valid and recognized by the IRS. It facilitates smoother communication between the IRS and the designated representative, if necessary.

Common Mistakes in Completing Form 941

A frequent error involves miscalculating the total taxes before any adjustments are made. This can lead to significant discrepancies in the amount reported and the actual tax liability. To avoid this, employers should double-check their calculations and ensure they are using the correct tax rates and wage bases. Utilizing payroll software that automatically calculates these amounts can also help prevent errors. Regular training for staff on tax calculation procedures is recommended to maintain accuracy.

Employers often overlook the need to adjust taxes for fractions of cents, sick pay, and other specific adjustments. This oversight can result in incorrect tax filings and potential penalties. It's crucial to review all payroll records for any necessary adjustments and apply them accurately. Employers should familiarize themselves with IRS guidelines on these adjustments to ensure compliance. Implementing a review process for each payroll cycle can help catch and correct these errors before filing.

Another common mistake is not subtracting nonrefundable credits from the total taxes owed. This can lead to overreporting the tax liability and overpaying taxes. Employers should ensure they are aware of all applicable nonrefundable credits and accurately apply them to reduce their tax liability. Keeping detailed records of all credits and consulting with a tax professional can aid in correctly applying these credits. Regularly updating payroll systems to automatically account for these credits can also prevent errors.

Incorrectly reporting the total deposits made for the quarter is a mistake that can lead to discrepancies in the tax return. Employers must accurately track and report all tax deposits made during the quarter. Utilizing a dedicated payroll account and maintaining detailed records of all deposits can help ensure accuracy. It's also beneficial to reconcile these deposits with bank statements before filing the return. Employing a systematic approach to tracking deposits can minimize the risk of errors.

Miscalculating the balance due or overpayment is a common error that can affect the financial planning and cash flow of a business. This mistake often stems from errors in calculating total taxes, adjustments, and credits. To avoid this, employers should carefully review all calculations and ensure they are accurately reflecting the business's tax situation. Using payroll software that automatically calculates the balance due or overpayment can help reduce the likelihood of errors. Additionally, consulting with a tax professional before filing can provide an extra layer of verification.

Failing to report the number of employees can lead to discrepancies in tax calculations and potential penalties. It's crucial to accurately report the number of employees to ensure the correct amount of taxes is withheld and paid. Employers should maintain up-to-date records of their workforce and review them before filling out Form 941. This ensures compliance with IRS requirements and avoids unnecessary complications.

Incorrectly indicating the deposit schedule can result in penalties for late or incorrect tax deposits. Employers must understand their deposit schedule based on their total tax liability and accurately report it in Part 2 of Form 941. It's advisable to consult the IRS guidelines or a tax professional to determine the correct deposit schedule. Accurate reporting helps in maintaining compliance and avoiding penalties.

Inaccurate business information can lead to processing delays and potential issues with tax filings. Employers must ensure that all details, including the business name, address, and EIN, are correctly entered in Part 3 of Form 941. Double-checking this information against official documents can prevent errors. Accurate business information is essential for the IRS to process the return efficiently.

An unsigned or undated Form 941 is considered incomplete and may be rejected by the IRS, leading to delays and potential penalties. It's imperative for the authorized person to sign and date the form before submission. Employers should establish a checklist that includes verifying the signature and date as part of the review process. This simple step ensures the form is complete and acceptable for processing.

Using an outdated version of Form 941 can result in the rejection of the tax return and the need to resubmit, causing delays. Employers should always download the latest version of Form 941 from the official IRS website before preparing their quarterly tax return. Staying informed about any changes to the form or instructions is crucial for compliance. Utilizing the most current form ensures that all information is reported according to the latest IRS requirements.

A frequent oversight when completing Form 941 is failing to collect all required wage and tax information before filing. This can lead to inaccuracies in reporting and potential penalties. Employers should ensure they have comprehensive records of all wages paid, tips reported, and taxes withheld for each employee. Utilizing payroll software or consulting with a payroll specialist can help in accurately gathering and reporting this information.

Mistakes in reporting taxable social security and Medicare wages are common and can result in discrepancies in tax liabilities. It's crucial to accurately calculate and report these wages, considering the wage base limits for social security taxes. Employers should double-check their calculations and refer to the IRS guidelines to ensure compliance. Regular training for payroll staff on the latest tax rules can also minimize errors.

Some employers mistakenly believe they are exempt from filing Form 941, leading to non-compliance with IRS requirements. It's essential to understand the criteria that necessitate filing, such as having employees and paying wages subject to withholding. Employers should review their payroll activities and consult IRS publications or a tax professional to determine their filing obligations. Establishing a checklist for quarterly tax responsibilities can aid in ensuring timely and accurate filings.

When employers authorize a third-party designee to discuss Form 941 with the IRS, errors in the authorization process can occur. This includes not providing complete and accurate information about the designee or misunderstanding the scope of the authorization. Employers should carefully complete the Third-Party Designee section of Form 941, ensuring all information is correct and that the designee understands their role. Clear communication and documentation between the employer and the designee are key to avoiding issues.

Submitting Form 941 to the wrong address or failing to file electronically when required can delay processing and result in penalties. Employers must verify the correct filing method and address based on their location and the IRS's current requirements. Utilizing the IRS's e-file system is recommended for most employers, as it facilitates faster processing and confirmation of receipt. Keeping updated with IRS announcements and guidelines can help employers stay compliant with filing procedures.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 941 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills irs-941 forms, ensuring each field is accurate.